The Age of Idleness

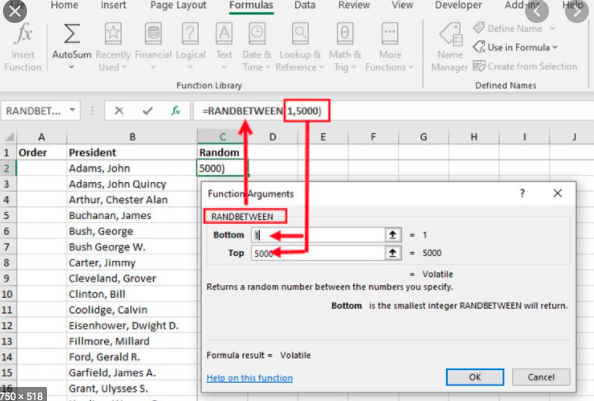

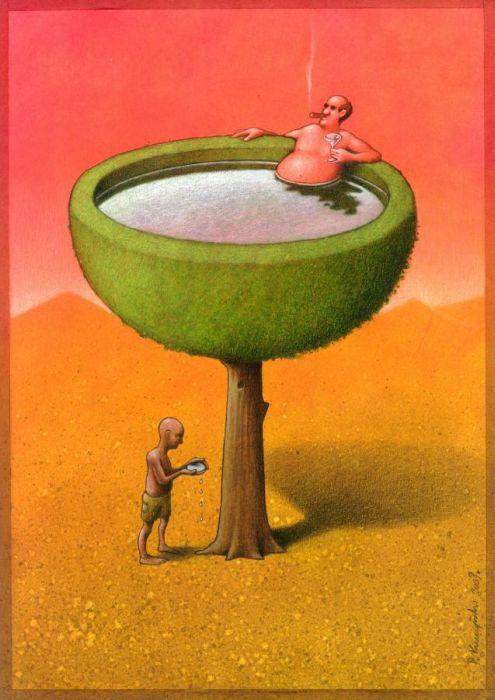

We stand idle in the heat Crammed onto a platform waiting for a train delayed by 10 minutes The platform is overcrowded move down the platform, move down the platform the announcer keeps saying To where I wonder I have spent the last 8 hours idly moving data around a spreadsheet something a computer could… Read More The Age of Idleness