There is no reason to have a lender when you borrow money, you can just borrow from yourself at zero interest.

How is this possible?

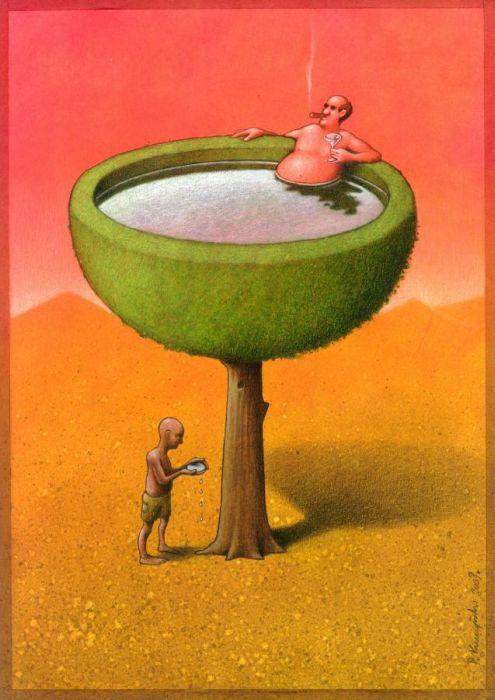

Our view of money and debt has changed significantly in the last 12 years since the GFC. We used to think banks took our deposits of government printed cash and lent them out to borrowers. Charging interest to compensate for risk and the time value of money (inflation). The banks would give the depositor some interest and take a slice for themselves. It then appeared that this had never really been the case.

When you borrow money the bank creates that money electronically from nothing. Then all they need to do is balance their books by getting a deposit or borrowing money from another bank – which is also made from nothing. Charging interest in this economy seems a bit weird as it seems to require ever increasing borrowing (money creation) to pay the interest.

Here’s a good TED talk on this topic:

Now we have a plethora of cryptocurrencies making money from nothing. However they all have trouble holding value, but we’ll tackle that problem a bit later.

So if we can just electronically create money why do we need the depositor, or the bank – the lender.

The argument for banks is they are needed to decide who to lend to, to credit assess people and organisations to ensure most of the money is paid back (actually destroyed ensuring there isn’t an oversupply of money). The past has shown that they aren’t particularly good at this and essentially they just follow a set of rules which could be easily embedded in an algorithm. They look at previous borrowing and repayment history, income, security, other assets. It would actually be easier for an algorithm to do this as we wouldn’t have to worry about privacy issues involved in sharing our private finance information with the bank. Also credit ratings agencies which many banks use have incomplete and often inaccurate data because we don’t share with them directly. They can also be bought as happened during the GFC.

How we could do it

Create a cryptocurrency with embedded proof of identity (secret of course) and maybe give all new people some currency to start with. Each person has two wallets, one with a positive balance and one with a negative balance. An algorithm decides how much you can borrow to start with. It will be a small amount say 100, if that 100 is paid back then you can borrow 200 next time etc etc. If you want to borrow more and have money coming in from another system or person you can allow the algorithm to see your positive account balance and transactions. It can then use this to calculate the amount you can borrow. Very similar to what a bank currently does but you don’t need to share your private information with a bunch of bank clerks.

Security (assets to support you borrowing) could also be provided to borrow more money and the algorithm automatically sells the asset if repayments aren’t made.

Each individual doesn’t need to balance their account daily like a bank does now because the whole system is in balance.

If a person does not pay back the loan they can’t borrow for a while or they revert to the start or maybe never. ( The criteria for the algorithm can be set from the start or could be altered if all people in the system vote to do so.)

This undestroyed money from default loans will increase overall money supply so will need to be destroyed, this can be done with a system of demurrage (destroying a small portion of existing money in positive accounts – a bit like inflation) or a transaction tax. Another algorithm can track the system as a whole to calculate the amount that must be destroyed. The percentages will be very low 1-2%

Why would anyone pay back the money?

People will pay it back to preserve their future ability to borrow, the same as today. Also they know that the whole system suffers if they don’t, not some rich banker, but everyone’s saving will slightly decrease if there are defaults. Community encourages honesty.

If anything people will be more likely to repay the loans, and this system is more stable than our current system so the risk of the whole thing collapsing and the government bailing it out is mitigated. Remember post GFC we all paid to bail out the banks.

Benefits

No interest – why would you charge yourself interest.

There is no lender to suffer if the money isn’t paid back, the only one to really suffer is you, the person who borrowed from themselves as you may not be able to borrow again.

No banks

A democratic, decentralised system creates money. Unlike today.

The whole process is very fast and transparent, you’d always know how much you can borrow.

No secretive credit agencies.

A self regulating finance and monetary system. No more central banks playing with interest rates, no more hyper inflation. No more needless complexity.

Currency stability

We do this by pegging a universal income to an index of external (fiat) currencies and further demurrage. Everyone receives some money periodically, and everyone has some of the money in their positive account destroyed periodically. The amounts are small 1.5-2% destroyed and 3000 per annum payment. However the payment is raised and lowered depending upon the cryptocurrencies value against the index of other currencies. If the value decreases the payment decreases restricting money supply which should force the value back up again. Arbiters who buy and sell currencies know this so any drop would be met with many new purchase orders and vice versa until the currency stabilizes around a 1 to 1 with the index. See http://arimaa.com/money/GETCoin.pdf for more info in this pegging system.

So in stabilising the currency against other currencies we have gained another benefit. A Universal Income for everyone. Highly beneficial in times of pandemic.

You may also notice that if you wanted to buy a house with US dollars you could borrow enough of this new cryptocurrency from yourself and exchange it for USD and it would remain stable so you can make the repayments interest free.

For more info have a look at:

https://shardus.com/ Scalable crypto currency

http://www.jesaurai.net/uncategorized/fixing-the-world/ Universal income and new currencies.

My book: Fluidity the way to true Demokratia available for free here: http://www.lulu.com/shop/david-campbell/fluidity-the-way-to-true-demokratia/ebook/product-23226582.html why interconnectedness is better than interdependence.

David J Campbell